If African parents had pushed financial literacy the same way they pushed religion, many of us would not be as confused as we are today.

Most of us were taught how to pray, how to obey, how to endure, but not how money works, how to save, how to invest, or how to prepare for the future. Faith was emphasized, which is good, but practical life skills were often missing. So we grew up spiritually aware, yet financially unprepared.

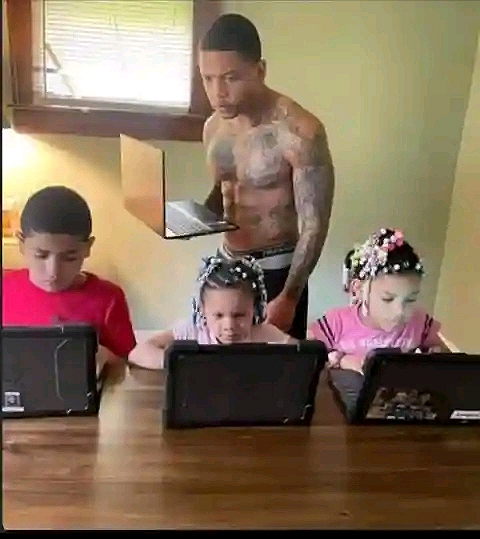

This is one of the reasons Western societies appear to be doing better. They don’t replace religion with money,they balance both. Children are taught values, but they are also taught skills, technology, and financial responsibility from an early age.

In many African homes, a child is forbidden from using a gadget until 18 or even 20. Not because gadgets are bad, but because of fear and lack of guidance. Instead of introducing these tools early, setting boundaries, monitoring usage, and teaching responsibility, they are completely withheld. Then suddenly, the child is expected to become competent overnight as an adult.

Technology is not the problem.

Money is not the problem.

The real problem is lack of guidance and education.

As youths and future parents, we must not repeat the same mistakes. We can raise children who are faithful and financially literate. Children who know God and know how to think, earn, save, and build.

That balance is how we prepare the next generation,not just to survive, but to thrive. #Michaelosita.

Most of us were taught how to pray, how to obey, how to endure, but not how money works, how to save, how to invest, or how to prepare for the future. Faith was emphasized, which is good, but practical life skills were often missing. So we grew up spiritually aware, yet financially unprepared.

This is one of the reasons Western societies appear to be doing better. They don’t replace religion with money,they balance both. Children are taught values, but they are also taught skills, technology, and financial responsibility from an early age.

In many African homes, a child is forbidden from using a gadget until 18 or even 20. Not because gadgets are bad, but because of fear and lack of guidance. Instead of introducing these tools early, setting boundaries, monitoring usage, and teaching responsibility, they are completely withheld. Then suddenly, the child is expected to become competent overnight as an adult.

Technology is not the problem.

Money is not the problem.

The real problem is lack of guidance and education.

As youths and future parents, we must not repeat the same mistakes. We can raise children who are faithful and financially literate. Children who know God and know how to think, earn, save, and build.

That balance is how we prepare the next generation,not just to survive, but to thrive. #Michaelosita.